Remember that old saw: “The rich get richer and the poor get poorer.” Ends up it’s true. Forbes reports that in 2015, not only did the wealth of the worlds 1826 billionaires increase to an aggregate $7.05 trillion, up from $6.4 trillion last year, but a whole whack of multimillionaires joined the billionaires’ ol’ boys’ club – 290 to be precise. “Ol’ boys’ club” isn’t just a euphemism here; of these 1826 billionaires, a paltry 190 are women, but even that’s up from last year’s 172.[1] The billionaire’s club doesn’t just reflect the sexism of our society, however; it mirrors its racism as well. The Forbes 400 includes just two blacks, TV’s anti-Christ Oprah Winfrey and financial investor Robert Smith, both Americans, along with a limousine’s worth of Latinos and Asians.[2]

At the end of 2015, Bill Gates remained the wealthiest man in the world, with a net worth of $79.2 billion, up $3.2 billion from the previous year. Although Mexican billionaire Carlos Slim remains in second place, at $77.1 billion, the stratosphere of ridiculous wealth largely hovers over the U.S., home to eight of the ten most wealthy people on the planet: the number three spot goes to American financier Warren Buffett, this year’s big gainer, up from number four, and a cool $14.5 billion richer than he was in 2014. The number five spot is also in American hands, Oracle’s Larry Ellison, at $54.3 billion. The malevolent Koch brothers share spots number six and seven. Wal-Mart’s Walton family holds spots number eight and nine, and is the richest family in the world. French L’Oreal heiress Liliane Bettencourt, at $40.1 billion, brings up the bottom of our top ten.[3] Not only do Americans hold eight of the top ten places, but they make up a total of 536 of the planet’s 1826 billionaires, substantially more than a quarter of the total, and this in a country of 321 million people,[4] or approximately 4.5% of the global population.

Comparatively, Canadian billionaires are a sorry lot. Canada’s richest man, media magnate David Thomson, is worth a mere $23.9 billion, making him the twenty-fifth wealthiest person in the world. In second place, in single digits, at $9.3 billion, is Galen Weston, CEO of the George Weston Ltd. grocery empire. At the bottom of Canada’s top ten is online poker king Mark Scheinberg, 369th among world billionaires, with a paltry $4.1 billion (how’s a guy to make ends meet; the life of a billionaire is expensive).[5] Canada has total of 40 billionaires,[6] representing 0.00011% of the total population, whereas the 536 American billionaires constitute 0.00017% of the U.S. population.

This fantastic concentration of wealth in the hands of a group of people that could fit into a hotel reception hall is, however, just the tip of the iceberg of U.S. wealth inequality. James K. Galbraith tells us that “the top 3 percent in the US rose from 44.8 percent of the nation’s wealth in 1989 to 51.8 percent in 2007 and 54.4 percent in 2013.” The upshot being: “The top 3 percent hold over double the wealth held by America’s poorest 90 percent of the population.”[7]

While Canada’s wealth inequality is not as glaring as that of our southern neighbour, we have nothing to crow about. The Conference Board of Canada tells us that in 2013, the last year for which solid figures are available, Canada ranked “12th out of 17 peer countries”[8] for wealth equality, making it the sixth most unequal country in the so-called first world. In concrete terms, this means that “While Canada falls well short of US levels of inequality, the OECD notes that we have become much a more unequal since the early 1980s. Today, the top 10% own almost half of all wealth.”[9]

***

Inequality, it ends up, has a way of breeding inequality. The situation of CEOs of major corporations – your garden-variety multimillionaires – reflects this burgeoning disparity. Les Leopold, author of Runaway Inequality, writes that “In 1970, a top 100 CEO received $45 in income for every dollar received by the average worker. By 2013, it was an astronomical $829 to $1.”[10] Looked at a different way, in 1995 “the gap between pay for large company CEOs and average workers ran 180 to 1. Today, it stands at 373 to 1.”[11] Much of this explosion has taken place in the past six years. Oxfam’s 2016 annual report tells us that “CEOs at the top US firms have seen their salaries increase by more than half (by 54.3%) since 2009.”[12]

The following list of the twenty-five best paid CEOs in America offers a sobering picture of what this means in dollars and cents:

We again find the ol’ boys club factor at play. The reader will note that this list includes just two women, Oracle’s Safra A. Catz and Yahoo’s Marissa Mayer (both in the tech sector, it is worth noting). Ironically, when compared with the twenty-four women on the Fortune 500 CEOs list, this is actually a significant overrepresentation.[14] Non-whites total 109, or 21.8%[15] – substantially lower than the 37% of the population they represent.[16]

Changes made to U.S. tax law in 1995 were allegedly meant to address overblown CEO salaries. A $1 million cap was placed on corporate tax deductions for executive pay. The spike in tax corporations would face as a result was meant to discourage exaggerated salaries. However, Section 162(m) simultaneously created a loophole you drive a Brinks armoured car full of money through. Performance bonuses were exempted from the $1 million cap. By simply restructuring their pay plans, corporations could simultaneously increase CEO pay packages and lower their tax bill. As Sarah Anderson and Scott Klinger point out, “this ‘performance pay’ loophole allowed 10 US corporations alone to cut their 2014 tax bill by more than $182 million through CEO pay-related deductions.” McKesson pharmaceutical corporation’s CEO John Hammergren offers a particularly egregious example of this ploy; he pocketed $112 million in fully deductible performance pay in 2014. The stock-pay incentive encouraged by this loophole has created a situation where Fortune 500 CEOs collectively own $270 billion of their companies’ stocks, or an average of $550 million each.[17]

CEOs do pretty good in their twilight years, as well. Anderson and Klinger report that “100 CEOs have company retirement assets that are equal to the entire retirement account savings of 41 percent of American families,” a nest egg of more than $49 million, or approximately $277,686 a month. Leading the pack is David Novak, CEO of fast-food giant YUM Brands, with a cool $234 million in his company retirement fund, which will translate into $1.3 million a month when he retires.[18]

Where your average working person faces a contribution limit for tax-deferred retirement plans – depending on age, between $18,000 and $24,000 a year – as was the case with corporate taxes, loopholes allow CEOs to make unlimited contributions. The upshot is that at the end of 2014, Fortune 500 CEOs collectively held $3.2 billion in tax-deferred retirement plans. The frontrunner in this category in 2014 was Glenn Renwick, CEO of the Progressive insurance company, who contributed $26.2 million to his tax-deferred retirement plan, saving him $10 million on his tax bill. It is worth noting that approximately half of these Fortune 500 CEOs will also be receiving a monthly pension cheque from corporation they worked for.[19]

Once again, in Canada, the numbers are not so astronomical. In 2014, the most recent data available, Canada’s top 100 CEOs made, on average, $8.96 million.”[20] As to the pay gap with your average worker: “In 1995, the 50 highest-paid CEOs in Canada earned 85 times what the average Canadian worker made. In 2014, this ratio had tripled: CEOs were making 253 times the earnings of the average Canadian worker.”[21] Canadian CEOs lag far behind their U.S. counterparts when it comes to stock options. Whereas Fortune 500 CEOs in the U.S. own an average of $550 million in stock options, the stock options collectively held by the CEOs of Canada’s major chartered banks only totalled $30.4 million.[22]

***

Tax avoidance by CEOs and on the salaries paid to CEOs are just the beginning of corporate tax avoidance, which serves both to deprive the state at all levels of necessary financial resources and to shift the overall tax burden onto the middle class and the poor. Oxfam reports that a review of “more than 200 companies, which included the 100 largest firms … found evidence that nine out of ten of them have a presence in at least one tax haven.” IMF data indicates that the amount of corporate cash stashed in tax havens “increased by almost four times between 2000 and 2014,” concluding that corporate tax-dodging practices “costs developing countries around $100bn annually.”[23] Meanwhile, Oxfam’s Raymond Offenheiser estimates that closing tax loopholes in the U.S. would generate approximately “220 billion additional dollars that we could invest in the economy over about a five- to 10-year period.”[24]

It’s not just corporations. Oxfam estimates that “$7.6 trillion of individual wealth – more than the combined gross domestic product (GDP) of the UK and Germany – is currently held offshore.” It’s estimated that this cost the world’s governments $190 billion in revenue each year.[25] What this means in practical terms is that the wealthiest 400 families in the U.S. end up paying a tax rate below that paid by your average working person. In the twenty years from 1992 to 2012, the rate of tax these families were paying dropped from 27% to 17%.[26] This compares to an average of 31.5% paid by a single American worker with no children.[27]

Besides creating previously unprecedented levels of inequality, this tax avoidance is “sucking the life out of welfare states in the rich world” and denying “poor countries the resources they need to tackle poverty, put children in school and prevent their citizens dying from easily curable diseases.” As Oxfam points out, cash-strapped governments have no option but “either to cut back on the essential spending needed to reduce inequality and deprivation or to make up the shortfall by levying higher taxes on other, less wealthy sections of society and smaller businesses in the domestic economy.” Either solution shifts the burden onto the poor. [28] As well as the disproportionately disadvantaging the less well off, the resulting tax shortfall also directly serves the interests of financial corporations. Les Leopold provides a salient example: “In Los Angeles, the fees paid to Wall Street each year to secure funds for infrastructure projects, are higher than the city’s entire road repair budget.”[29]

When it comes to tax avoidance, Canadian corporations show themselves to be equally skilled. In 2014, in a report on legal tax avoidance strategies, Canadian Business offered the following sobering examples, “Canadian Pacific Railway paid an average effective cash tax rate of just 1.8% over the past decade. Manitoba Telecom paid 4.1%. Gildan Activewear paid 5.5%. And First Capital Realty has gone for years without paying any cash taxes at all.” The report further noted that “A new policy that just came into effect in 2009 allows Canada to sign tax information exchange agreements with countries such as Bermuda, the Cayman Islands and the Isle of Man … allowing companies to set up subsidiaries in these jurisdictions and bring their profits home tax-free,” concluding that “By implementing this policy, the government is literally providing a strong cash incentive for companies to move operations out of the country.”[30]

Just as is the case for U.S. CEOs, the reorganization of pay packages allows CEOs in Canada to avoid paying taxes on much of their income. Stock options in particular open the door to massive tax avoidance. As Hugh Mackenzie of the Canadian Centre for Policy Alternatives explains:

When a CEO actually exercises previously granted stock options (i.e., exercises his or her right to buy the stock at the pre-determined price) the income crystallized in the transaction is taxed at half the normal rate, as if it were a capital gain rather than ordinary income. So from an after-tax perspective, a dollar received from the exercise of a stock option is worth two dollars of salary income. The difference in tax paid – half the top marginal rate of taxation, or 26% on average across Canada – amounts to a public subsidy paid to these already highly compensated executives.[31]

It is little wonder that the International Bar Association refers to systemic and sanctioned tax avoidance as “an abuse of human rights,” while the president of the World Bank calls it “a form of corruption that hurts the poor.”[32]

***

Tax avoidance is not, of course, a stand-alone phenomenon. It is part and parcel of the wave of deregulation introduced by neoliberal governments in the late seventies and early eighties and expanded upon thereafter – the deregulation of the financial sector arguably being both the most significant and most damaging aspect. Financial corporations began aggressively buying up other corporations, using enormous amounts of borrowed money to do so. Then, to pay off the pursuant accumulated debt, these financialized corporations “squeezed (their) workers, shipped production abroad, sold off assets, cut back on R&D…, and even used bankruptcy to further cut costs.” The outcome in the U.S. was that “upwards to 40 percent of all corporate profits were transferred to Wall Street through financial strip-mining (even though Wall Street accounts for only 5 percent of our jobs).”[33]

This “strip-mining” and the concomitant destruction of the manufacturing sector in First World countries is only one source of the increasing concentration of capital in the financial sector. What the financial sector does produce – its bread and butter, if you will – is debt. “Corporations now are so debt ridden that more than 30 percent of the cost of any item we buy goes to interest payments up and down the supply chain.” Alongside this corporate debt, the deregulation of mortgages and credit cards, led to a the untenable situation, whereby, in the U.S., household debt skyrocketed to 125% of household income, fuelling the 2008 crash, from which the economy has yet to recover.[34]

Destroying the American manufacturing sector and essentially bankrupting the nation was not, however, without its benefits for the financial sector. As Mark Karlin tells us:

After deregulation took hold, there was an enormous premium for working on Wall Street. Financial wages shot through the roof, while non-financial wages stagnated. At the same time, the top 1 percent saw their share of the national income rise from about 8 percent to more than 20 percent and their share of national wealth rise to over 40 percent.[35]

Let’s break that down a bit. Oxfam tells us that the “financial sector has grown most rapidly in recent decades, and now accounts for one in five billionaires.” This growth, “driven in particular by the growth of large banks and other financial companies in the US, Canada and Europe,” resulted in this sector creating “some of the biggest and most profitable companies in the world, including 437 of the world’s 2,000 largest companies in 2014, according to the Forbes Global 2000 rankings,” with “financial companies in this group (having) assets five times larger on average than non-financial companies.”[36]

In fact, “In the US, the financial industry now accounts for about 30 percent of all operating profits, double its share in the 1980s; but is responsible for less than 10 percent of value-added in the economy.” In spite of the sectors low level of productivity, employees are paid “roughly 30-50 percent … over and above what they add in value.”[37] In 2014, for example, “Wall Street banks handed out $28.5 billion in bonuses to their 167,800 employees last year, up 3 percent over 2013,” this at a time when industry profits decline by 4.5%.[38]

This “bonus pool is so large it would be far more than enough to lift all 2.9 million restaurant servers and bartenders, all 1.5 million home health and personal care aides, or all 2.2 million fast food preparation and serving workers up to $15 per hour.” Beyond the issues of productivity and inequality, there are broader issues of overall economic health at play here. Moody’s Analytics tells us that “every extra dollar going into the pockets of a high-income American only adds about $0.39 to the GDP,” while “every extra dollar going into the pockets of low-wage workers adds about $1.21 to the national economy.” So had this $28.5 billion gone to low-income workers the U.S. “GDP would have grown by about $34.5 billion.”[39] As a result of this disconnect between salaries in the financial sector and productivity, “the gap increases between the ultra-rich who have interests in this sector and everyone else, deepening inequality.”[40]

Financialization has also been a problem in Canada. Writing in 2012, former Canadian Auto Workers economist Jim Stanford has pointed out that “Canada’s economic base is being steadily narrowed in the face of globalization and financialization.” At that point:

Of the 50 largest corporations, fully 20 are resource producers… Ten are financial and life insurance companies… Another six are holding and property companies…, and three more are pipeline companies… By that reckoning, 39 of the top 50 companies in Canada are either resource or financial firms. That’s a precarious concentration of our national economic eggs in just a couple of baskets.[41]

Perhaps the most telling sign of the level of financialization in Canada is to be found in the fact that in 2013, Canada’s four most profitable public companies were banks.[42]

***

Inevitably this concentration of vast wealth in so few hands has political implications. In 2015, former President Jimmy Carter referred to the U.S. political system as “an oligarchy with unlimited political bribery,”[43] while Joseph Stiglitz has quipped, “We’ve moved from a democracy, which is supposed to be based on one person, one vote, to something much more akin to one dollar, one vote,” drawing the obvious conclusion: “When you have that kind of democracy, it’s not going to address the real needs of the 99 percent.”[44]

In the case of the U.S., the Supreme Court 2010 decision in Citizens United v. FEC to strike down the ban on corporate federal election donations effectively opened the floodgates to massive influence peddling. A Sunlight Foundation study, for example, found that 200 most politically active corporations spent “a combined $5.8 billion on campaign contributions and federal lobbying expenditures.” While these 200 corporations “account for 1 percent only of all lobbying clients,” they “are responsible for about 26 percent of the total amount spent on lobbying expenditures.” The profit they’ve made on this investment, which the Sunlight Foundation places at $4.4 trillion, is more than impressive. That amounts to $760 for every dollar donated. Just to take one example, Blue Cross Blue Shield, number eighteen on the list, “has its own provision in a tax code, saving the company as much as $1 billion every year.” Insurance companies alone are eligible for tax breaks that amount to $30 billion a year. [45]

Tax breaks are only one form of kickback. “Of the $3 trillion the federal government issued in contracts between 2007-2012, the Fixed Fortune 200 earned $1 trillion.” Additionally, 174 of the 200 were granted state and local subsidies. As well, sixteen of these corporations received bailouts under the Troubled Asset Relief Program set up by the George W. Bush government to address the 2008 subprime mortgage meltdown,and twenty-nine received Federal Reserve handouts.[46]

Perhaps the most unabashed of U.S. plutocrats are David and Charles Koch, with a collective net worth in excess of $85 billion. They, to all intents and purposes, announced their intention to buy the 2016 election. They will spend a total $889 million in an effort to influence the outcome, more than double the $400 million they spent on the 2012 election.[47] As such, the Koch brothers will be spending almost as much on this election campaign as will each of the two main parties.[48] The upshot, as Michel Swenson argues, is that the Koch brothers have “created a pseudo-political party of conservative rich activists,” but without the annoying obligation to “register under campaign finance laws, follow financial reporting rules of a political party, or reveal donors.”[49] This pseudo-party, which Jane Mayer describes as a “right-wing political network,” includes “about 400 other extraordinarily wealthy conservatives (who) create a kind of a billionaire caucus”[50] and employs “three-and-a-half times as many employees as the Republican National Committee.” Jane Mayer calls this political machine “an assembly line to manufacture political change.” [51]

It is little wonder that in this political system, to quote Joseph Stiglitz:

Virtually all U.S. senators, and most of the representatives in the House, are members of the top 1 percent when they arrive, are kept in office by money from the top 1 percent, and know that if they serve the top 1 percent well they will be rewarded by the top 1 percent when they leave office. By and large, the key executive-branch policymakers on trade and economic policy also come from the top 1 percent. When pharmaceutical companies receive a trillion-dollar gift – through legislation prohibiting the government, the largest buyer of drugs, from bargaining over price – it should not come as cause for wonder. It should not make jaws drop that a tax bill cannot emerge from Congress unless big tax cuts are put in place for the wealthy.[52]

This is one area in which Canada has largely avoided the pitfalls of the U.S. system, establishing strict and fairly modest donation limits; neither corporations nor trade unions are permitted to make donations, and individual donations are “limited to up to $1,500 a year to each political party and up to $1,500 to all of the registered electoral district associations, contestants seeking the party’s nomination and candidates for each party. In addition, donors may give up to $1,500 to leadership candidates. These limits were set in 2015, and the amounts increase by $25 each year.”[53]

Under current law, it would also be impossible to buy a Canadian election in the way the Koch brothers and their cronies hope to buy the 2016 presidential election. “Groups or individuals other than political parties and candidates may spend no more than $150,000 to try to persuade voters during an election, and no more than $3,000 of that may be spent in any one district.[54]

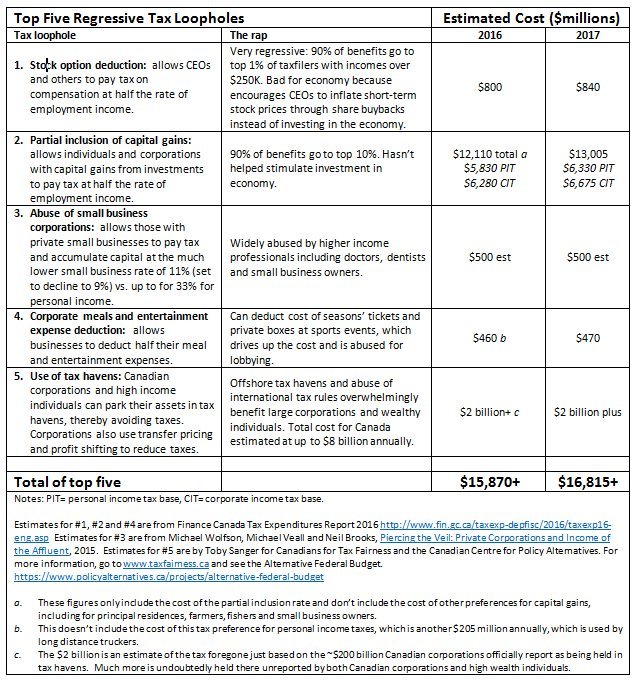

On the face of it, one might get impression that big business in Canada is more constrained than its American counterpart – and clearly that is in some ways true – but unless gaping tax loopholes are closed corporations will continue to have ample opportunity to legally avoid their fiscal responsibilities. Canadian Union of Public Employees’ economist Toby Sanger, identifies five such loopholes that will cost the Canadian government approximately $16 billion a year for the next two years:[55]

When one considers that Federal Minister of Finance Bill Morneau is predicting a deficit of $18.4 billion during the next fiscal year,[56] the solution seems obvious.

While

Canadians may feel a certain sense of satisfaction at avoiding the

egregious levels of inequality found in the U.S., they need keep in mind

that The Conference Board of Canada tells us that Canada is the sixth

most unequal country in the first world – hardly a source of pride.

[1] Kerry A. Dolan and Luisa Kroll, “The world’s richest people 2015,” Yahoo! Finance, (March 2, 2015), accessed at: https://ca.finance.yahoo.com/news/the-worlds-richest-people-2015-181201159.html

[2] Rivera Sun, Sipping Champagne on the Titanic: Twenty Billionaires Own More Than the Bottom Half of Americans, Truthout (December 9, 2015), accessed at: http://www.truth-out.org/opinion/item/33956-sipping-champagne-on-the-titanic-twenty-billionaires-own-more-than-the-bottom-half-of-americans

[3] Dolan & Kroll, “The world’s richest people 2015,” accessed at: https://ca.finance.yahoo.com/news/the-worlds-richest-people-2015-181201159.html

[4] Adele M. Stan, “2016: The Year of the Billionaire,” Alternet (January 1, 2016), accessed at: http://www.alternet.org/election-2016/2016-year-billionaire?akid=13845.7338.UWlD8k&rd=1&src=newsletter1048309&t=4[5] Pamela Heaven, “Forbes billionaires list 2016 reveals the richest Canadians on the planet,” Financial Post (Marc 1, 2016), accessed at:

http://business.financialpost.com/news/economy/forbes-rich-list-2016-reveals-the-richest-canadians-on-the-planet[6] Lauren Pelley, “Canada’s richest make Forbes’ 2015 billionaires list,” The Star (March 2, 2016), accessed at: http://www.thestar.com/business/2015/03/02/forbes-billionaires-list-features-a-basketball-legend-and-more-women.html

[7] C.J. Polychroniou, “James K. Galbraith on the Human Cost of Inequality in the Neoliberal Age,” Truthout (November 12, 2015), accessed at: http://www.truth-out.org/opinion/item/33622-james-k-galbraith-on-the-human-cost-of-inequality-in-the-neoliberal-age

[8] “Income Inequality,” The Conference Board of Canada (January 2013), accessed at: http://www.conferenceboard.ca/hcp/details/society/income-inequality.aspx

[9] Andrew Jackson, “The Return of the Gilded Age: Consequences, Causes and Solutions” (The Harry Kitchen Lecture in Public Policy), The Broadbent Institute (April 8, 2015), 2

[10] Mark Karlin, “Runaway Inequality Is Ripping Us Apart,” Truthout (December 13, 2015), accessed at: http://www.truth-out.org/progressivepicks/item/33992-runaway-inequality-is-ripping-us-apart

[11] Sarah Anderson and Scott Klinger, “The Terrible Things That Happen When Santa Claus Visits CEOs,” Truthout (December 24, 2015), accessed at: http://www.truth-out.org/news/item/34168-the-terrible-things-that-happen-when-santa-claus-visits-ceos

[12] Oxfam America, 210 Oxfam Briefing Paper: An Economy for the 1% (Oxford: Oxfam GB, 2016), 4.

[13] Kali Holloway, “Meet the Most Overpaid CEOs in America,” Alternet (February 18, 2016), accessed at: http://www.alternet.org/news-amp-politics/meet-most-overpaid-ceos-america?akid=13988.7338.iTxQLU&rd=1&src=newsletter1050970&t=4

[14] Oxfam America, 210 Oxfam Briefing Paper, 4.[15] Richard L. Zweigenhaft, “Diversity Among CEOs and Corporate Directors: Has the Heyday Come and Gone?”, Who Rules America? (2014), accessed at: http://www2.ucsc.edu/whorulesamerica/power/diversity_among_ceos.html

[16] Eric Kayne, “Census: White majority in U.S. gone by 2043,” NBC News (June 13, 2013), accessed at: http://usnews.nbcnews.com/_news/2013/06/13/18934111-census-white-majority-in-us-gone-by-2043

[17] Anderson and Klinger, “The Terrible Things That Happen When Santa Claus Visits CEOs,” accessed at: http://www.truth-out.org/news/item/34168-the-terrible-things-that-happen-when-santa-claus-visits-ceos

[18] Sarah Anderson and Scott Klinger, “100 CEOs’ Nest Eggs = Retirement Savings of 41% of Families,” Alternet (October 26, 2015), accessed at: http://www.alternet.org/print/economy/100-ceos-nest-eggs-retirement-savings-41-families

[19] Anderson and Klinger, “100 CEOs’ Nest Eggs = Retirement Savings of 41% of Families,” accessed at: http://www.alternet.org/print/economy/100-ceos-nest-eggs-retirement-savings-41-families

[20] Hugh Mackenzie, “Staying Power: CEO Pay in Canada,” Canadian Centre for Policy Alternatives (January 2016), 7.

[21] Mackenzie, “Staying Power,” 11.

[22] Mackenzie, “Staying Power,” 12.

[23] Oxfam America, 210 Oxfam Briefing Paper, 20.

[24] Raymond Offenheiser, “The 1% Economy: The World’s Richest 62 People Now Have as Much as Poorest 3.6 Billion,” Democracy Now! (January 21, 2016), accessed at: http://www.democracynow.org/2016/1/21/the_1_economy_the_worlds_richest?utm_source=democracy+now%21&utm_campaign=56626afb84-daily_digest&utm_medium=email&utm_term=0_fa2346a853-56626afb84-191727937

[25] Oxfam America, 210 Oxfam Briefing Paper, 32.

[26] Stan, “2016: The Year of the Billionaire,” accessed at http://www.alternet.org/election-2016/2016-year-billionaire?akid=13845.7338.UWlD8k&rd=1&src=newsletter1048309&t=4[27] Bernie Becker, “Average US worker pays 31.5 percent tax rate,” The Hill (April 14, 2015), accessed at: http://thehill.com/policy/finance/238735-average-us-worker-pays-315-pct-tax-rate-report

[28] Oxfam America, 210 Oxfam Briefing Paper, 20.

[29] Karlin, “Runaway Inequality Is Ripping Us Apart,” accessed at: http://www.truth-out.org/progressivepicks/item/33992-runaway-inequality-is-ripping-us-apart[30] Duncan Hood, “Why are some Canadian companies paying almost no tax?”, Canadian Business (February 27, 2014), accessed at: http://www.canadianbusiness.com/blogs-and-comment/why-are-some-canadian-companies-paying-almost-no-tax-duncan-hood[31] “Here’s the eye-popping chart about CEO pay every Canadian needs to see,” Press Progress (January 4, 2016), accessed at: http://www.pressprogress.ca/here_s_the_eye_popping_chart_about_ceo_pay_every_canadian_needs_to_see

[32] Oxfam America, 210 Oxfam Briefing Paper, 20.

[33] Karlin, “Runaway Inequality Is Ripping Us Apart,” accessed at: http://www.truth-out.org/progressivepicks/item/33992-runaway-inequality-is-ripping-us-apart

[34] Karlin, “Runaway Inequality Is Ripping Us Apart,” accessed at: http://www.truth-out.org/progressivepicks/item/33992-runaway-inequality-is-ripping-us-apart

[35] Karlin, “Runaway Inequality Is Ripping Us Apart,” accessed at: http://www.truth-out.org/progressivepicks/item/33992-runaway-inequality-is-ripping-us-apart

[36] Oxfam America, 210 Oxfam Briefing Paper, 36.

[37] Oxfam America, 210 Oxfam Briefing Paper, 23.

[38] Sarah Anderson, “Off the Deep End: The Wall Street Bonus Pool and Low-Wage Workers,” Moyers & Company (March 18, 2015), accessed at: http://billmoyers.com/2015/03/18/deep-end-wall-street-bonus-pool-low-wage-workers/

[39] Anderson, “Off the Deep End” accessed at: http://billmoyers.com/2015/03/18/deep-end-wall-street-bonus-pool-low-wage-workers/

[40] Oxfam America, 210 Oxfam Briefing Paper, 24. [41] Jim Stanford, “Canada: Land of mines and banks,” rabble.ca (July 4, 2012), accessed at: http://rabble.ca/columnists/2012/07/canada-land-mines-and-banks

[42] “List of largest public companies in Canada by profit,” Wikipedia, accessed at: https://en.wikipedia.org/wiki/List_of_largest_public_companies_in_Canada_by_profit

[43] Chuck Collins, “Do the Rich Rule the United States?”, Truthout (August 21, 2015) accessed at: http://www.truth-out.org/opinion/item/32460-do-the-rich-rule-the-united-states

[44] “Joseph Stiglitz on Ways to Lessen Inequality in the United States,” Democracy Now! (June 6, 2012), accessed at: http://www.democracynow.org/blog/2012/6/6/part_2_joseph_stiglitz_on_ways_to_lessen_inequality_in_the_united_states

[45] Ben Cohen and John Bonifaz, “There’s Never Been a Better Time to Be a Corporation,” Truthout (February 1, 2016), accessed at: http://www.truth-out.org/opinion/item/28832-there-s-never-been-a-better-time-to-be-a-corporation

[46] Cohen and Bonifaz, “There’s Never Been a Better Time to Be a Corporation,” accessed at: http://www.truth-out.org/opinion/item/28832-there-s-never-been-a-better-time-to-be-a-corporation

[47] Michele Swenson, “‘Supreme Court Five’ Unleash Government Of, By and For the Oligarchs,” Huffpost (January 28, 2015), accessed at: http://www.huffingtonpost.com/michele-swenson/supreme-court-five-unleas_b_6558656.html?utm_hp_ref=politics&ir=Politics

[48] “Dark Money: Jane Mayer on How the Koch Bros. & Billionaire Allies Funded the Rise of the Far Right,” Democracy Now! (January 20, 2016), accessed at: http://www.democracynow.org/2016/1/20/dark_money_jane_mayer_on_how?utm_source=Democracy+Now%21&utm_campaign=141bbeb64f-Daily_Digest&utm_medium=email&utm_term=0_fa2346a853-141bbeb64f-191727937

[49] Swenson, “‘Supreme Court Five’ Unleash Government Of, By and For the Oligarchs,” accessed at: http://www.huffingtonpost.com/michele-swenson/supreme-court-five-unleas_b_6558656.html?utm_hp_ref=politics&ir=Politics

[50] “Dark Money,” accessed at: http://www.democracynow.org/2016/1/20/dark_money_jane_mayer_on_how?utm_source=Democracy+Now%21&utm_campaign=141bbeb64f-Daily_Digest&utm_medium=email&utm_term=0_fa2346a853-141bbeb64f-191727937

[51] “The Kochs & the Nazis: Book Reveals Billionaires’ Father Built Key Oil Refinery for the Third Reich,” Democracy Now! (January 20, 2016), accessed at:

[52] Joseph E. Stiglitz, “Of the 1%, by the 1%, for the 1%,” Vanity Fair (May 2011), accessed at: http://www.vanityfair.com/society/features/2011/05/top-one-percent-201105

[53] “Political Party Financing,” Historica Canada, accessed at: http://www.thecanadianencyclopedia.ca/en/article/party-financing/

[54] “Political Party Financing,” Historica Canada, accessed at: http://www.thecanadianencyclopedia.ca/en/article/party-financing/

[55] Daniel Tencer, “Tax Loopholes For Rich Cost Canada $16 Billion A Year: Study,” The Huffington Post Canada (February 24, 2016), accessed at: http://www.huffingtonpost.ca/2016/02/24/tax-loopholes-canada-toby-sanger_n_9309578.html[56] Andy Blatchford, “Bill Morneau: Federal Deficit Projected At $18.4B, Likely To Exceed $20B At Budget Time,” HuffPost Politics Canada (February 22, 2016), accessed at: http://www.huffingtonpost.ca/2016/02/22/finance-minister-to-spell-out-canada-s-downgraded-economic-outlook-source_n_9288342.html